1: Explain how the incidence of an indirect tax depends on the price elasticity of demand and the price elasticity of supply.

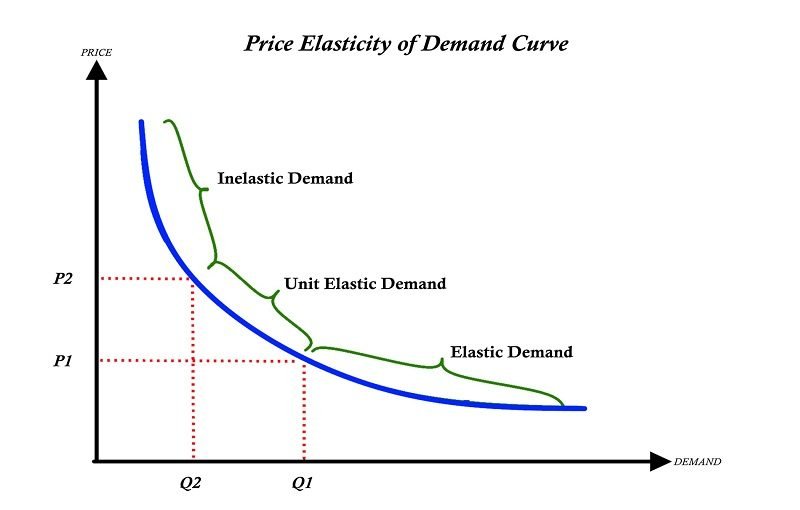

2: Using diagrams, explain how the incidence of an indirect tax may be affected by the price elasticity of demand.

3: Explain the factors which might influence of the cross price elasticity of demand between different products.

4: Examine the importance of income elasticity of demand for the producers of primary products, manufactured goods and services.

5: Explain the importance of price elasticity of demand and cross-elasticity of demand for business decision-making.

6: Studies have shown that the demand for tobacco tends to be highly price inelastic. Evaluate the view that governments can best reduce smoking by substantially increasing taxes on cigarettes.